The GST Council has reduced taxes on 23 goods and services, to go to effect from January 1, 2019.

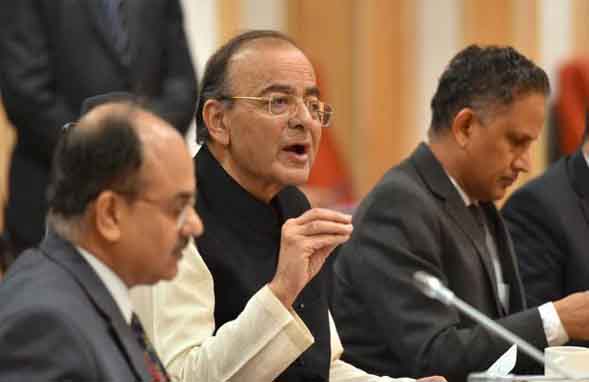

The Finance Minister Arun Jaitley announced these changes after the 31st meeting of the Goods and Services Tax Council.

Of the 23 items, 7 of these are from the 28 percent slab. Now, 28 items remain in the 28 percent tax bracket.

The list of items that will get cheaper are:

From 28% to 18% tax:

- Pulleys, transmission shafts and cranks, gear boxes etc., falling under HS Code 8483

- Monitors and TVs of up to screen size of 32 inches

- Re-treaded or used pneumatic tyres of rubber;

- Power banks of lithium ion batteries.

- Digital cameras and video camera recorders

- Video game consoles and other games and sports requisites falling under HS code 9504.

From 28% to 5%:

- Parts and accessories for the carriages for disabled persons

On Services

- Cinema tickets above Rs. 100 shall be reduced from 28% to 18% and on cinema tickets up to Rs 100 from 18% to 12%.

- 3rd-party insurance premium of goods carrying vehicles shall be reduced from 18% to 12%

- Services supplied by banks to Basic Saving Bank Deposit (BSBD) account holders under Pradhan Mantri Jan Dhan Yojana (PMJDY) shall be exempted.

- Services supplied by rehabilitation professionals recognised under Rehabilitation Council of India Act, 1992 at medical establishments, educational institutions, rehabilitation centers established by Central Government / State Government or Union Territories or entity registered under section 12AA of the Income-tax Act shall be exempted.

- Services provided by GTA to Government departments/local authorities which have taken registration only for the purpose of deducting tax under Section 51 shall be excluded from payment of tax under RCM and the same shall be exempted.

- Exemption on services provided by Central or State Government or Union Territory Government to their undertakings or PSUs by way of guaranteeing loans taken by them from financial institutions is being extended to guaranteeing of such loans taken from banks.

- Air travel of pilgrims by non-scheduled/charter operations, for religious pilgrimage facilitated by the Government of India under bilateral arrangements shall attract the same rate of GST as applicable to similar flights in Economy class (i.e. 5% with ITC of input services).

And many other items have also been shifted from their respective tax slabs.

This reform been celebrated most publicly by the Bollywood community, with Akshay Kumar, Aamir Khan and Karan Johar tweeting their appreciation for the reduction of taxes on cinema tickets. Bollywood superstar Aamir Khan tweeted: “Heartfelt thank you to Honorable PM & the Govt of India for considering the request of the film industry for reduction in GST. If Indian cinema hopes to compete in the world market then we need the support of the Govt & Administration. This is a great 1st step in that direction.”