India and Oman are strong partners in the Indian Ocean Rim Region, and are connected by geography and historical trade ties. Both are flourishing trade partners in the region

INTRODUCTION

India and Oman share a long tradition of bilateral economic and cultural relations. This friendship between the two states was forged by the waves of the Indian Ocean several centuries ago. In recent times, the two countries have ensured that they remain allies and engage in economic and social exchanges. Over the last decade, bilateral visits have laid emphasis on increasing investment, trade and economic ties.

CURRENT STATE OF ECONOMIC AFFAIRS

Trade and commerce form the most important aspect of bilateral relations between India and Oman. On the other hand, Omani exports include fertilisers, mineral fuels, mineral oils and products of their distillation, bituminous substances, mineral wax, aluminium, organic chemicals, salt, sulphur, lime and cement.

There exists a lot of potential for the expansion of trade between the two countries. Policymakers in both countries are aware of this and have taken appropriate measures in this direction. The constant pursuit of the Narendra Modi government, since its inception in 2014, to improve India’s performance in the Ease of Doing Business (EoDB) rankings has wooed several foreign investments into the economy. Policies such as ‘Invest India’ and ‘Make in India’ have been used as gateways for foreign investment. At the same time, Omani foreign policy has been shaped by its concerns of a post-petroleum economy. Key strategic location

of Oman along the Indian Ocean and the Persian Gulf has given Oman a comparative advantage in exporting trade logistic services. The creation of several Free Zones (FZs) and a Special Economic Zone (SEZ) along its coast – Salalah, Sohar, Al Mazunah FZ and Duqm SEZ, in line with the nation’s Vision 2020 Vision 2020 and Vision 2040 – aims to reduce the contribution of the oil sector in the GDP. Therefore, Oman realises the need to move beyond the conventional sectors and diversify its economy. There also exist complementarities between the two countries. India and Oman complement each other by exporting manufacturing services and energy, respectively, to each other. These complementarities, along with the existing trade routes, will allow bilateral trade to flourish. This convergence in the respective domestic and foreign policies has provided the much needed impetus to boost trade ties between the two nations. Joint Business Councils (JBCs) meetings are held regularly in New Delhi and Muscat alternately. These business meetings were aimed at bringing together major businessmen in each country to facilitate future investments and joint ventures. An Oman India Joint Investment Fund (OIJIF), a special purpose vehicle, was created to fund investments in either country. This is a joint venture between the State General Reserve Fund (SGRF), the Omani Sovereign Wealth fund, and the State Bank of India (SBI), the largest commercial bank in India. During the first rounds of investment, the OIJIF invested in a portfolio comprising of companies such as Solar, ING Vysya Bank, HBL, Indus Teqsites, GSP Crop Science Pvt. Ltd., NCDEX and SSIPL. The first tranche of US$100 million was fully utilised in these investments. OIJIF has raised another US$220 million for its Tranche-II and is being invested in India.

The investment criteria of the joint fund emphasises on the growth potential, comparative advantage, governance, pricing power and healthy return ratios of the prospective companies. Therefore, the nature of investment by the OIJIF has the philosophy of sustainability deeply ingrained in it. Once again, this points to the sustained relationship between the two nations.

A few Indian companies have invested heavily in Oman. These investments have utilised the facilities provided at the FZs and SEZ. Besides this, India has a sizeable expatriate population living in Oman. They contribute to the GDP of Oman and also repatriate some of their income back to the home economy which, in turn, boosts the Indian markets. The circular flow of income suggests that this will have a spiral effect on national income of India as well. Apart from these firms, Indian banks such as Bank of Baroda and State Bank of India have also set up branches in Oman.

A BRIGHTER FUTURE

Both Oman and India have highlighted the potential for further trade, investment and cooperation between the two nations. The OIJIF was set up and it has been successful in utilising the initial corpus of funds. A second tranche worth US$ 220 million has already been allocated for further investment. So far, Divgi Torq Transfer System, Annapurna Finance and Stanley Lifestyles have received funds from this fund. It is expected that investment will be expanded using the fund in the near future. Such investments, especially in the infrastructure sector, will help fast track India’s progress towards becoming a developed state.

According to the World Bank Ease of Doing Business (2019) report, the two countries are similarly placed – Oman at 78 and India at 77. This augurs well for businessmen in Oman looking to invest in India – thereby increasing inward FDI into India.

Adequate measures for protecting the interests of minority investors, the relative ease in getting credit and electricity bolster India’s position in attracting investment. Oman, on the other hand, is performing well in tax payment methods, registering property and easy entry policies for businesses.

Further cooperation in areas of energy like wind and solar, waste management, tourism, space, health and education has also been addressed in the JBC meetings held in Muscat earlier this year.

INDIA-OMAN TOURISM

Maritime links between India and Oman, since the Indus Valley Civilization, have been a defining feature of the historical ties between the two countries. Naturally, people-to-people contacts and exchanges have been a key feature of the contemporary India-Oman relations. A notable feature of people-to-people contacts between India and Oman in recent times has been the increasing flow of tourists into ‘Incredible India’ from Oman. In the recent years, India has also emerged as a preferred destination for medical and wellness tourism, with numerous Omanis choosing India for their medical treatment at various stateof-the-art hospitals.

In 2017, over 100,000 visas were issued to Omanis. These included over 65,000 visas issued by the Indian Embassy and about 36,000 electronic visas issued through the online visa portal. The introduction of the electronic visa or e-visa has eased the process of obtaining a visa to travel to India. It is very encouraging to observe that the number of Omanis who obtained an e-visa for India through a completely online procedure have jumped from 4,734 in 2016 to 35,921 (marking a 7.5 times increase) and about 45,000 during Jan-Aug 2018. In fact, in 2018, about 70 percent of the visas issued to Omanis were e-visas. Omanis travel to India mainly for tourism, and for medical and business purposes. In 2017, over 50 percent of the visas issued by the Embassy were tourist visas, while over 30 percent were medical attendant visa.

CONCLUSION

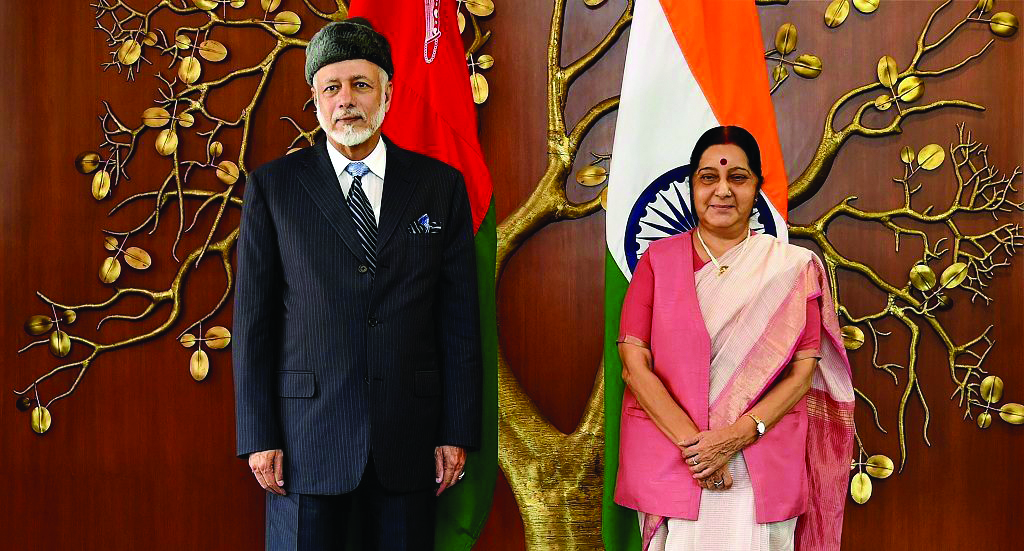

Both India and Oman accord high priority to strengthening economic and commercial relations between the two countries. Economic cooperation between India and Oman is reviewed thorough the institutional mechanism of Indo-Oman Joint Commission Meeting (JCM). Traditionally, IndoOman Joint Business Council (JBC) also runs parallel with JCM and serves as a platform for interaction between captains of Industry in India and Oman. The 8th Session of JCM and 9th Session of JBC were held on 16-17 July 2018 in Muscat, cochaired by Ministers of Commerce and Industry of the two countries.

India is among Oman’s top trading partners. For Oman, India was the 4th largest (after UAE, US and China) source for its imports and 3rd largest market (after UAE and Saudi Arabia) for its non-oil exports in 2017. India imported 9.6 % of Oman’s total oil exports in 2017. During 2017-2018, bilateral trade reached US$ 6.7 billion, registering a 67.5 per cent increase over US 4 billion in 2016-17. Major items of Indian exports are mineral fuels and products of their distillation, textiles, machinery, electrical items, chemicals, iron and steel, tea, coffee, spices, rice and meat products and seafood. Among major Indian imports are: urea, LNG, polypropylene, lubricating oil, dates and chromite ore. An IndiaGCC framework agreement on trade is in place and negotiations are on for finalization of a FTA

with GCC.

Investment flows, both ways, have been robust, as reflected in numerous joint ventures, established both in India and Oman. According to Oman’s Ministry of Commerce and Industry, there are over 3200 Indian enterprises and establishments in Oman. Oman-India Joint Investment Fund (OIJIF) is a 50-50 Joint Venture between State Bank of India and State General Reserve Fund (SGRF) of Oman, the main sovereign wealth fund of Oman. It was set up in July 2010 as a special purpose vehicle (SPV) to invest in India.

OIJIF commenced its operations in 2011 with initial seed capital of US$ 100 million which was fully invested across seven Indian companies from diversified sectors. OIJIF has raised another US$ 220 million for its Tranche-II and is being invested in India.

Indian firms have invested heavily Oman in various sectors like iron and steel, cement, fertilizers, textile, cables, chemicals, automotive, etc. In Sohar, with an estimated total Indian investment of over US$2 billion, Indian entities comprise the largest foreign investors. In Salalah, Indianinvestments are in manufacturing of automotive parts, textiles, cables, guar gum, etc. In Duqm SEZ, an Indo-Oman JV Sebacic Oman is undertaking a US$ 1.2 billion project for setting up the largest Sebacic acid plant in Middle-East. A ‘Little India’ integrated tourism complex project in Duqm, worth US$ 748 million on completion, has been signed. In addition, L&T, Jindal, EPIL, Shapoorji Pallonji,

Shriram, Aditya Birla Group, Nagarjuna

Construction Company, KEC International, etc. are some big Indian companies which has been executing various projects in Oman. Indian financial institutions like SBI, Bank of Baroda, HDFC Ltd and ICICI

Securities as well as Indian PSUs like

Air India, Air India Express, LIC, New India Assurance Co., TCIL, EIL, EPIL and NBCC have presence in Oman.

Oil & Gas:

India purchases oil from Oman in spot market. In 2017, India was the second largest (after China) importer of Oil from Oman and imported 28239.5 barrels in 2017. Indian Oil Corporation has acquired 17% stake of Royal Dutch Shell in Makhaizana oilfield in Oman for US$ 329 million.

Connectivity:

There are a total of around 260 direct flights per week between Oman (Muscat and Salalah) and 11 destinations in India. Air India, Air India Express, Indigo, Spice Jet and Jet Airways, along with Oman Air, are operating flights between India and Oman.

Tourism: India is among preferred destination for tourism and medical tourism for Omanis. Number of visas availed by Omanis in 2017 has reached 101,454, including around 36,000 e-visas.

ITEC:

Under the Indian Technical & Economic Cooperation (ITEC) Programme, Omani Officials have been availing training in many premier institutes of India. A total of 125 training slots have been offered to Oman for the FY 2018-19 under the ITEC programme.

THE ROAD AHEAD

Besides the strategic and military ties between India and Oman, India should look forward to invest more heavily in Oman. Economic expansion will mutually benefit both the nations and also strengthen India’s foothold in the region, all of which can further solidify the stability of the Indian Ocean for all trade players.